Discover gives considered one of the lowest minimum amount yearly proportion prices (APRs) and also a competitive utmost APR to borrowers with credit score scores of a minimum of 660.

Time to fund: Exact working day with the present Citi account, or within just 2 business enterprise days having a non-Citi account

Prequalified premiums are based on the information you supply in addition to a delicate credit rating inquiry. Obtaining prequalified fees doesn't guarantee that the Lender will extend you an offer of credit score. You are not nonetheless authorised to get a loan or a particular fee.

We're pledged towards the letter and spirit of U.S. coverage for your achievement of equivalent housing prospect all through the Country.

Right before agreeing to the loan, make sure you you should definitely will make your loan payments in entire and in time. We support the responsible utilization of loans and understand that no-one is aware your scenario better than you.

The organization also charges additional fees than a few of its opponents and would not offer immediate spend or autopay savings. If you want a seven-year term loan, you'll need to appear elsewhere. Achieve private loans will not be out there in all states.

“I’m definitely excited to become here. London is where I grew up And that i’m joyful being back again,” Sancho mentioned in a statement on the Chelsea Web-site.

It’s an option for truthful-credit rating borrowers, which has a bare minimum credit history score of 600, in addition to Individuals with lessen incomes.

Personal debt consolidation and bank card refinancing include using a new loan to pay off your existing harmony. This doesn't eliminate debt, but replaces a single credit card debt with A further. While personal loan prices usually are reduced than credit card interest rates, you might spend much more in origination expenses and desire over the life of the loan based upon other loan terms. You should check with a monetary advisor to determine if refinancing or consolidating is good for you.

Our group on a regular basis collects information on Each individual organization’s loan choices and conditions, such as bare minimum and utmost loan quantities, origination fees and discount rates.

LendingClub is really a good lender for good credit borrowers and some fair credit borrowers that utilize directly on its website. It is simple to prequalify with LendingClub, particularly when you're not comfortable furnishing your Social Protection range, as the organization does not demand it on the prequalification stage. (You will need to deliver it if you progress forward with a comprehensive application.)

Credit card debt Financial debt relief Very best debt administration Most effective personal debt settlement Do you need a financial debt management approach? What is financial debt settlement? Debt consolidation vs. debt settlement Must you agree your financial debt or pay out in complete? How to barter a credit card debt settlement all on your own Personal debt assortment Can a credit card debt collector garnish my checking account or my wages? Can credit card more info corporations garnish your wages?

This lender doesn’t demand any fees on its loans, and There are many methods to get a discount in your fee — like enrolling in autopay or getting direct deposits which has a SoFi examining or savings account. SoFi also offers many Added benefits to its users, such monetary organizing assets.

Dollars Progress: Definition, Sorts, and Influence on Credit score Rating A income progress is actually a provider provided by bank card issuers that allows cardholders to right away withdraw a sum of cash, typically at a superior interest rate.

Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Susan Dey Then & Now!

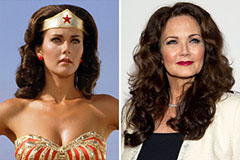

Susan Dey Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!